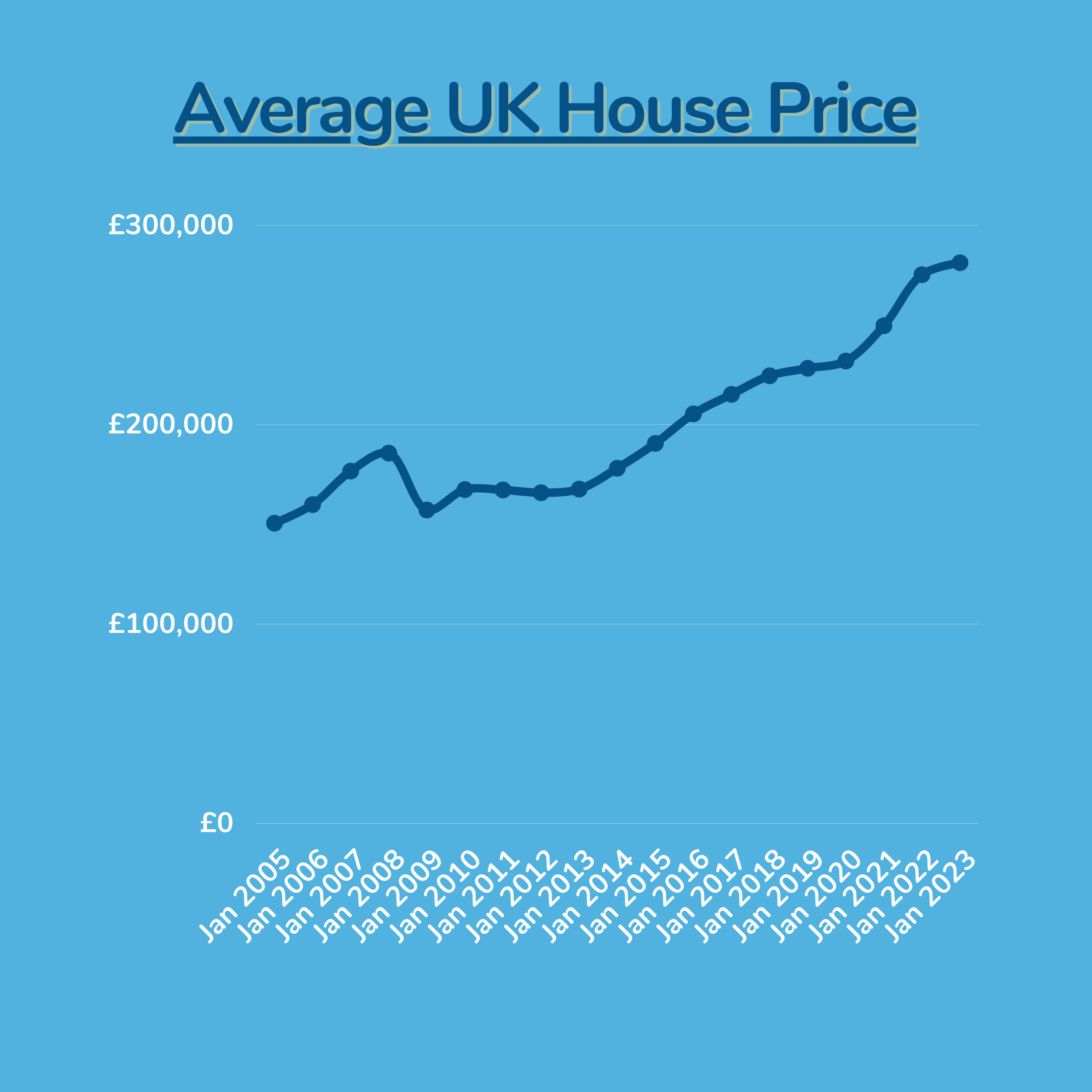

Moreover, January saw a further monthly price fall (-0.6%), which left prices 3.2% lower than their August peak (after taking account of seasonal effects).

The average price of a home now stands at £258,297.

Robert Gardner, Nationwide’s chief economist, said: “There are some encouraging signs that mortgage rates are normalising, but it is too early to tell whether activity in the housing market has started to recover. The fall in house purchase approvals in December reported by the Bank of England largely reflects the sharp decline in mortgage applications following the mini-Budget.

“As we highlighted in our recent affordability report, the biggest change in terms of housing affordability for potential buyers over the last year has been the rise in the cost of servicing the typical mortgage as a result of the increase in mortgage rates.

“Should recent reductions in mortgage rates continue, this should help improve the affordability position for potential buyers, albeit modestly, as will solid rates of income growth (wage growth is currently running at around 7% in the private sector), especially if combined with weak or negative house price growth.

“High house prices relative to earnings mean deposit requirements remain a major challenge. Moreover, the Help To Buy Equity Loan scheme that helped those with a smaller deposit buy a new build property is due to end in March. However, the government’s mortgage guarantee scheme, which helps to secure the availability and lower the cost of higher loan-to-value mortgages, has been extended until the end of 2023.

“All regions have seen a deterioration in affordability compared to 2021, with the cost of servicing the typical mortgage as a share of take-home pay now at or above the long-run average in all regions.

“There continues to be a significant gap between the least affordable and most affordable regions, although this has remained broadly stable over the last year. London continues to have the highest house price to earnings ratio at 9.2, but this is still below its record high of 10.2 in 2016.

“But there is substantial regional variation, as illustrated below, which shows the average time it would take someone earning the typical wage in each region to save a 20% deposit towards an average FTB property, assuming they set aside 15% of their take-home pay each month.”

Mark Harris, chief executive of mortgage broker SPF Private Clients, added: “Average property prices continue to fall month-on-month, as higher mortgage costs, along with the rising cost of living, have an inevitable impact on affordability.

“The swap rate volatility sparked by the the mini-Budget has largely dissipated and fixed-rate mortgage pricing continues to fall. Five-year fixes are now available for not much more than 4%, with Virgin Money launching a five-year fix of 4.17% this week.

“While the markets expect a 50 basis point rise in interest rates at February’s meeting, fixed-rate mortgages are set to continue to fall, while those on variable rates will see an uptick in their monthly repayments.”